Window Energy Efficient Tax Credit . The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. energy efficient home improvement credit. This breaks down to a total limit of $1,200 for any. These expenses may qualify if they meet requirements detailed. the small business energy incentive is designed to help businesses improve energy efficiency and save on. federal tax credits for energy efficiency. under the $1 billion household energy upgrades fund, the clean energy finance corporation (cefc) will work with lenders to provide discounted. the overall total limit for an efficiency tax credit in one year is $3,200. The inflation reduction act of 2022 empowers americans to make homes and buildings more energy.

from www.kbkg.com

The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. These expenses may qualify if they meet requirements detailed. the small business energy incentive is designed to help businesses improve energy efficiency and save on. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. federal tax credits for energy efficiency. The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. energy efficient home improvement credit. This breaks down to a total limit of $1,200 for any. the overall total limit for an efficiency tax credit in one year is $3,200. under the $1 billion household energy upgrades fund, the clean energy finance corporation (cefc) will work with lenders to provide discounted.

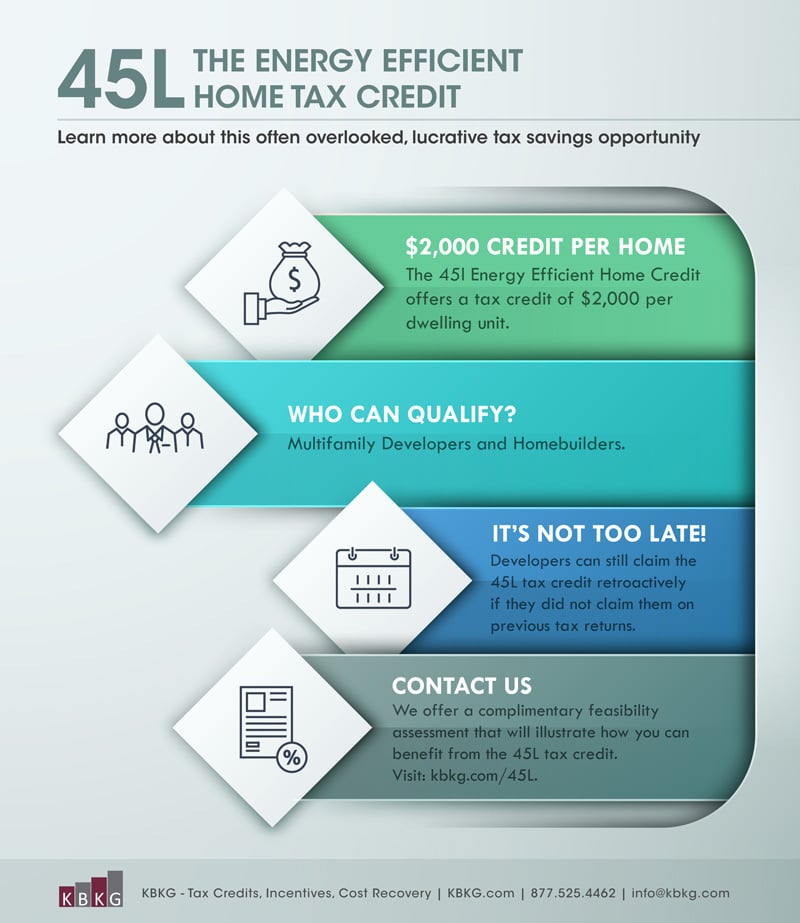

45L Tax Credit Energy Efficient Tax Credit 45L

Window Energy Efficient Tax Credit energy efficient home improvement credit. This breaks down to a total limit of $1,200 for any. The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. These expenses may qualify if they meet requirements detailed. energy efficient home improvement credit. The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. the small business energy incentive is designed to help businesses improve energy efficiency and save on. federal tax credits for energy efficiency. the overall total limit for an efficiency tax credit in one year is $3,200. under the $1 billion household energy upgrades fund, the clean energy finance corporation (cefc) will work with lenders to provide discounted.

From www.homeconstructionimprovement.com

Energy Efficient Windows Which Qualify for Federal Tax Credits for Window Energy Efficient Tax Credit The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. These expenses may qualify if they meet requirements detailed. the small business energy incentive is designed to help businesses improve energy efficiency and save on. The inflation reduction act of 2022 empowers americans to make homes and buildings more energy.. Window Energy Efficient Tax Credit.

From www.msn.com

Energyefficient tax credits explained Window Energy Efficient Tax Credit federal tax credits for energy efficiency. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. the small business energy incentive is designed to help businesses improve energy efficiency and save on.. Window Energy Efficient Tax Credit.

From www.bruincorp.net

Tax Credits for Replacement Energy Efficient Windows Window Energy Efficient Tax Credit the overall total limit for an efficiency tax credit in one year is $3,200. The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. federal tax credits for energy efficiency. energy efficient home improvement credit. This breaks down to a total limit of $1,200 for any. learn. Window Energy Efficient Tax Credit.

From blindsdesigns.com

Federal Tax Rebate, Energy Efficient Window Shades Blinds & Designs Window Energy Efficient Tax Credit The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. These expenses may qualify if they meet requirements detailed. the small business energy incentive is designed to help businesses improve energy efficiency and save on. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. federal. Window Energy Efficient Tax Credit.

From blog.turbotax.intuit.com

Residential Energy Efficient Property Tax Credit Helps You Go Green and Window Energy Efficient Tax Credit The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. the overall total limit for an efficiency tax credit in one year is $3,200. federal tax credits for energy efficiency. This breaks down to a total limit of $1,200 for any. energy efficient home improvement credit. the small business energy incentive. Window Energy Efficient Tax Credit.

From www.simply-windows.com

Learn About Federal Tax Credits for Efficient Window Treatments! Window Energy Efficient Tax Credit This breaks down to a total limit of $1,200 for any. the overall total limit for an efficiency tax credit in one year is $3,200. the small business energy incentive is designed to help businesses improve energy efficiency and save on. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,.. Window Energy Efficient Tax Credit.

From www.klatzkin.com

Energy Efficient Tax Deductions Residential Clean Energy Credit Window Energy Efficient Tax Credit This breaks down to a total limit of $1,200 for any. These expenses may qualify if they meet requirements detailed. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. federal tax credits for energy efficiency. The home energy support program provides up to $5,000 in rebates for eligible act homeowners to. Window Energy Efficient Tax Credit.

From ntwindow.com

Energy Tax Credit NT Window Window Energy Efficient Tax Credit The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. This breaks down to a total limit of $1,200 for any. These expenses may qualify if they meet requirements detailed. under the $1 billion household. Window Energy Efficient Tax Credit.

From thewealthywill.wordpress.com

“Get Tax Credits for EnergyEfficient Upgrades with the Residential Window Energy Efficient Tax Credit federal tax credits for energy efficiency. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. the small business energy incentive is designed to help businesses improve energy efficiency and save on. This breaks down to. Window Energy Efficient Tax Credit.

From www.woodbridgehomesolutions.com

How to Apply for EnergyEfficiency Tax Credits StepbyStep Guide Window Energy Efficient Tax Credit The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. This breaks down to a total limit of $1,200 for any. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. under the $1 billion household energy upgrades fund, the clean energy finance. Window Energy Efficient Tax Credit.

From www.timesunion.com

Federal tax credits for energy efficiency Window Energy Efficient Tax Credit federal tax credits for energy efficiency. under the $1 billion household energy upgrades fund, the clean energy finance corporation (cefc) will work with lenders to provide discounted. energy efficient home improvement credit. The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. learn the steps for claiming. Window Energy Efficient Tax Credit.

From www.resnet.us

U.S. Department of Energy to Approve Software Tools to Calculate Window Energy Efficient Tax Credit These expenses may qualify if they meet requirements detailed. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. energy efficient home improvement credit. under the $1 billion household energy upgrades fund, the clean energy finance corporation (cefc) will work with lenders to provide discounted. This breaks down to a total. Window Energy Efficient Tax Credit.

From www.resnet.us

Outlines Energy Efficient Tax Credit Changes in TBD Window Energy Efficient Tax Credit The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. under the $1 billion household energy upgrades fund, the clean energy finance corporation (cefc) will work with lenders to provide discounted. federal tax credits for energy efficiency. The inflation reduction act of 2022 empowers americans to make homes and. Window Energy Efficient Tax Credit.

From www.evergreenyourhome.com

What To Look For In Energy Efficient Windows Evergreen Home Performance Window Energy Efficient Tax Credit The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. the small business energy incentive is designed to help businesses improve energy efficiency and save on. These expenses may qualify if they meet. Window Energy Efficient Tax Credit.

From www.kbkg.com

45L The Energy Efficient Home Credit Extended through 2017 Window Energy Efficient Tax Credit The home energy support program provides up to $5,000 in rebates for eligible act homeowners to help with the. energy efficient home improvement credit. These expenses may qualify if they meet requirements detailed. the small business energy incentive is designed to help businesses improve energy efficiency and save on. the overall total limit for an efficiency tax. Window Energy Efficient Tax Credit.

From greatlakeswindow.com

Energy Efficient Windows Great Lakes Window Window Energy Efficient Tax Credit the overall total limit for an efficiency tax credit in one year is $3,200. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. energy efficient home improvement credit. The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. federal tax credits for energy efficiency.. Window Energy Efficient Tax Credit.

From www.foxnews.com

For energy efficiency, replace your windows last Fox News Window Energy Efficient Tax Credit energy efficient home improvement credit. The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. federal tax credits for energy efficiency. the overall total limit for an efficiency tax credit in one year is $3,200. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,.. Window Energy Efficient Tax Credit.

From www.soft-lite.com

Tax Credits for Qualified Energy Efficient Improvements SoftLite Windows Window Energy Efficient Tax Credit The inflation reduction act of 2022 empowers americans to make homes and buildings more energy. under the $1 billion household energy upgrades fund, the clean energy finance corporation (cefc) will work with lenders to provide discounted. learn the steps for claiming an energy efficient home improvement tax credit for exterior doors, windows,. federal tax credits for energy. Window Energy Efficient Tax Credit.